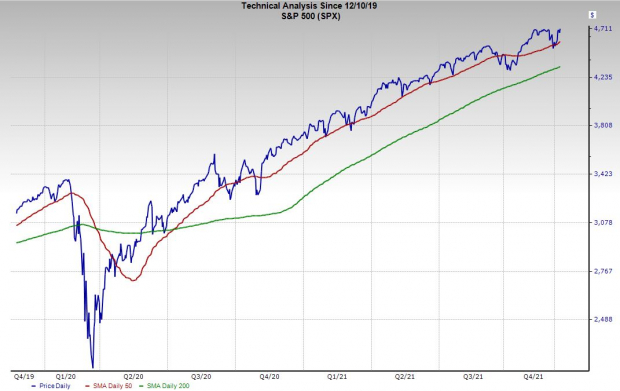

Wall Street shook off nearly 40-year high inflation data to propel the S&P 500 back to new closing records. Inflation jumped 6.8% in November, which was actually below some estimates of 7% or more.

– Zacks

– Zacks

Investors remain focused on the positives, despite high prices that could force the Fed’s hand earlier than projected as they think about where the economy was at the end of 2020. Additionally, Wall Street has continued to pump cash since It seemed relatively clear that the new covid variant would not lead to major lockdowns in the US or a massive global shutdown.

JP Morgan also came out on a very bullish note on Wednesday. The Wall Street titan, specifically its top global markets strategist, Marko Kolanovic, wrote in a note to clients: “Our view is that 2022 will be the year of a full global recovery, the end of the pandemic and a return to normal economic and market conditions that we had before the COVID-19 outbreak.”

Even though the market is back at its highs, the strength of mega-cap tech stocks like Apple clouds the fact that tons of pandemic-winning stocks and growth stocks remain under pressure, with many trading at or near 52 week minimums. This is healthy because investors are recalibrating many names that were severely overheated amid the euphoric runs on the virus lows that continued after the initial vaccine announcement.

The bulls helped the market post its best week since February. But many strong stocks have not returned to their records. Given the context, investors may want a chance to buy some top-notch stocks at a discount heading into 2022. Here are two components of Dow worth considering …

Image : Zacks Investment Research

Image : Zacks Investment Research

Walmart WMT

Walmart exceeded our third-quarter earnings and earnings estimates in mid-November and increased its targeting of supply chain bottlenecks and rising labor costs. Company executives also assured Wall Street and shoppers that their shelves will remain stocked throughout the vital Christmas season. And investors don’t seem to care much that its comparable sales for the third quarter of fiscal 22 were up 9% compared to an extremely difficult period to compete last year.

Walmart posted a banner year in 2020 (FY21), with sales increasing 7% and increasing 9%, driven by massive e-commerce growth. Despite being its best performer in more than a decade, Zacks estimates call for WMT’s revenue to rise another 2.2% this year and 2.7% more next year to reach $ 587 billion.

Image : Zacks Investment Research

Image : Zacks Investment Research

These estimates have risen significantly in recent months and would see it roughly match its pre-pandemic growth rates. Additionally, your adjusted earnings are projected to increase 16% this year and an additional 5% next year. Still, Walmart shares are down 4% in the past year versus the 28% rise in the S&P 500, amid struggles from the broad-based retail sector.

Walmart closed regular business hours Friday 7% off its highs and 21% below its current Zacks consensus price target of $ 172 per share. The stock is also trading near its own two-year lows at 20.7 times future 12-month earnings, also marking a solid discount to its industry average. Investors should also know that 13 of the 19 brokerage recommendations Zacks has are “hard buys,” with three more “buys” and three “holds.”

Walmart earns a Zacks Rank # 3 (Hold) right now, along with its “B” rating for Value and “A” for Momentum in our Style Score system. And its 1.56% dividend yield exceeds the recent 10-year Treasury rise and the S&P 500 average.

Image : Zacks Investment Research

Image : Zacks Investment Research

The company has spent the last few years preparing for the future. WMT in 2020 launched its subscription service called Walmart + to compete directly against Amazon Prime. The service costs $ 98 and offers unlimited free delivery, fuel discounts, access to new-age checkout deals in the store, and more. This is in addition to its variety of delivery and e-commerce options.

Walmart is also expanding its base through diversification, such as partnering with Shopify to bring more small businesses to its third-party market. Additionally, your digital advertising business is on track to become a multi-billion dollar segment a year. And WMT is poised to enhance its financial services offerings and roll out telehealth services nationwide.

The Walt Disney Company DIS

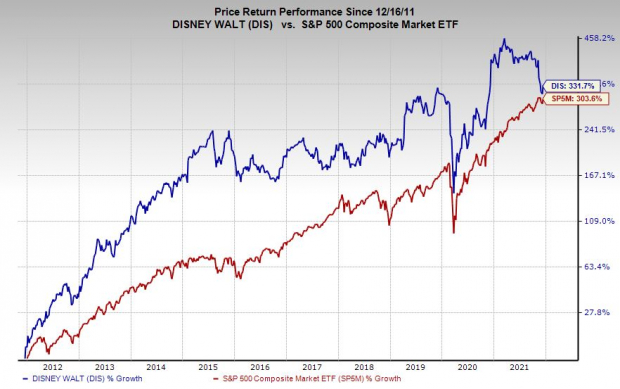

Shares of Walt Disney tumbled following its big loss of earnings for the fourth quarter of fiscal year 21 on November 10, which broke the trend of strong rhythms from the entertainment titan. Wall Street also expressed dissatisfaction with the growth of its streaming segment. Disney +, which launched in November 2019, added just over two million subscribers last quarter to close its fiscal year with 118.1 million subscribers versus the Wall Street consensus of 125.3.

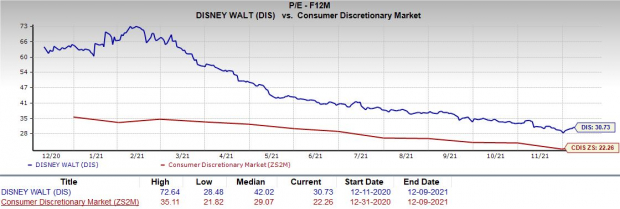

Disney’s downfall was based on the loss of EPS and slowdown in streaming growth. But the sell-off was going to come sooner rather than later, as DIS shares overheated quite a bit during the great pandemic, even as its parks and theatrical businesses nearly came to a halt. The stock went from trading at 26 times future 12-month earnings in early 2020 to 72 times in February 2021. Disney was trading at 30.7 times on Friday, and its shares were down 25% from its records.

Image : Zacks Investment Research

Image : Zacks Investment Research

Disney’s Zacks consensus price target represents a 30% increase from its current levels of $ 152. Additionally, it is trading closer to where it was before the pandemic in terms of EPS multiples, despite the fact that now is a broadcast powerhouse poised to be one of the most successful ventures in a crowded field. This is essentially a whole new business in addition to its parks and resorts and theatrical premieres that have already recovered and are ready to bounce back in a big way as people yearn to get back to the fun. Not to mention, it still operates a linear TV segment and other ancillary offerings.

Disney’s content library is full of movies and shows that people can’t get anywhere else, including Marvel, Star Wars, Pixar, National Geographic, and Disney. Its huge library, which is often a must-have for families, is a big reason why it destroyed its original streaming subscriber screenings so quickly, along with the locks.

Company executives reiterated their Disney + subscriber guide from 230 million to 260 million by the end of fiscal 24, which squashed their initial projection of 60 million to 90 million from fall 2019. On top of that, the total streaming of Disney reached 179 million on Disney +, ESPN + and Hulu— NFLX closed the third quarter with 214 million. The company’s streaming package is very attractive as consumers are flooded with too many different options.

Disney’s revenue increased 26% in the fourth quarter and 3% for the year and is projected to rebound. Zacks estimates call for its fiscal year 22 revenue to rise 24% to crush its pre-covid totals by $ 14 billion to $ 84 billion, and fiscal year 23 will rise a further 12% to $ 94 billion. Meanwhile, its adjusted earnings are expected to skyrocket 87% in fiscal year 22 and 36% in fiscal year 23.

Image : Zacks Investment Research

Image : Zacks Investment Research

Disney’s consensus earnings estimates fell slightly after its updated guidance, but it appears most of the downside has already been discounted. Despite the big selloff, Wall Street remains bullish on stocks, with 11 of the 17 brokerage recommendations Zacks has on “Strong Buys,” with two more “Buys” and nothing under “Hold.” .

Disney earns a Zacks Rank # 3 (Hold) right now, along with an “A” rating for growth in our style scoring system. And it has already regained some momentum, up 7% since the beginning of December. The move pulled it out of oversold RSI levels and still remains below neutral at 43. Disney could continue to face short-term selling and uncertainty, but investors with a year or more outlook could consider taking DIS at these levels.

5 actions configured to duplicate

Each was selected by a Zacks expert as the # 1 favorite stock to win + 100% or more in 2021. Previous recommendations have skyrocketed + 143.0%, + 175.9%, + 498.3%, and + 673.0%.

Most of the stocks in this report are flying under the Wall Street radar, providing a great opportunity to break into the ground floor.

Today, check out these 5 possible home runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download the 7 best stocks for the next 30 days. Click to get this free report

Walmart Inc. (WMT): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

Tips Clear – Media Surfer News Tips Clear: Your Daily Dose of Expert Advice

Tips Clear – Media Surfer News Tips Clear: Your Daily Dose of Expert Advice