We know that the earnings picture remains strong, even though the growth pace is expected to decelerate significantly in Q3 and beyond. What we don’t…

Grow Your Business,

Not Your Inbox

Stay informed and join our daily newsletter now!

5 min read

This story originally appeared on Zacks

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- We know that the earnings picture remains strong, even though the growth pace is expected to decelerate significantly in Q3 and beyond. What we don’t know at this stage is whether the incremental change in the earnings outlook over the coming days, as reflected in earnings estimate revisions, will be positive or negative.

- Estimates for 2021 Q3, whose early reports will start coming out in the coming days, have not moved up as much as had been the case in the comparable periods in the last few quarters. That said, the revisions trend remains positive and could very well gain pace as the reporting cycle gets underway.

- Total Q3 earnings for the S&P 500 index are expected to be up +26.2% from the same period last year on +13.7% higher revenues. This would follow the +94.6% earnings growth on +25.1% higher revenues in Q2.

- For the 493 S&P 500 members that have reported Q2 results already, total earnings are up +95.9% on +25.5% higher revenues, with 87.2% beating EPS estimates and 86.8% topping revenue estimates.

- The notable positives in the Q2 reporting cycle included broad-based strength, with the aggregate quarterly earnings total reaching a new all-time record, impressive momentum on the revenue side and continued positive estimate revisions for the current period (2021 Q3) and beyond, albeit at a decelerated pace.

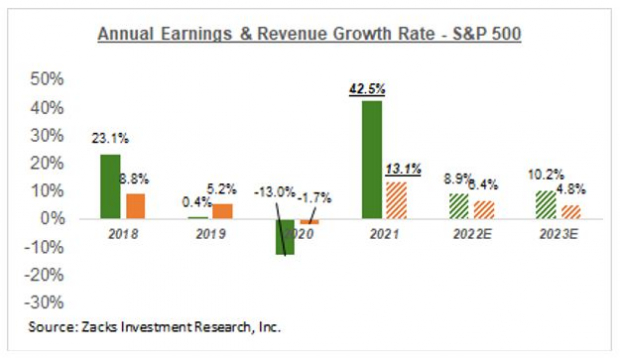

- Looking at the calendar-year picture for the S&P 500 index, earnings are projected to climb +42.5% on +13.1% higher revenues in 2021 and increase +8.9% on +6.4% higher revenues in 2022. This would follow an earnings decline of -13% on -1.7% lower revenues in 2020.

- The implied ‘EPS’ for the S&P 500 index, calculated using the current 2021 P/E of 23.4X and index close, as of August 31st, is $193.98, up from $136.10 in 2020. Using the same methodology, the index ‘EPS’ works out to $211.23 for 2022 (P/E of 21.5X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

The earnings focus lately has been on retailers and the numbers from that space are as strong and impressive as we have been seeing consistently from other sectors in the Q2 reporting cycle.

Results from most of the specialty and department store operators were as strong as those from the big-box players. In fact, the earlier results from Walmart WMT, Target TGT, Home Depot HD and Lowe’s LOW provided useful read-through about the state of the consumer.

The market’s varied reaction to the big-box results isn’t so much a function of the quality of the reports, but rather how these stocks had performed in the run up to the results. The state of the consumer remains strong and these retailers have refined their business models to capitalize on this favorable backdrop.

The long-feared drop off in growth from these big-box operators in the post-Covid world has yet to fully materialize, though rising costs from a number of areas including inputs, freight, payroll and supply-chain disruptions cast doubts about the margins outlook. That said, these headwinds are hardly unique to the retail space, as we heard consistently from management teams across different sectors.

We discussed the Retail sector’s scorecard in greater detail in the body of the report. But suffice it to say, the sector’s Q2 results have been strong, following the trends elsewhere.

The Earnings Big Picture

Looking past the Q2 earnings season, the expectation is for earnings growth of +26.2% on +13.7% higher revenues in 2021 Q3. Estimates for the current period (2021 Q3) have gone up, as the chart below shows.

Image : Zacks Investment Research

Please note that while the Q3 estimate revisions trend remains positive, it is not as strong as we had seen in the comparable periods of the preceding two quarters. It might be nothing more than a reflection of analysts’ tentativeness about the impact of the ongoing Delta variant, but it is nevertheless something we will be closely monitoring in the days ahead.

The chart below provides a big-picture view of earnings on a quarterly basis.

Image : Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image : Zacks Investment Research

We remain positive in our earnings outlook, as we see the full-year 2021 growth picture steadily improving, with the revisions trend accelerating in the back half of the year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Lowes Companies, Inc. (LOW): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research