After the last tumultuous two weeks, the bulls have held out this week as the major indices are back in the green for December. This month typically gives investors some reasons to be happy. Historically one of the strongest months, December is up 1.5% on average since 1950 and ends in green almost 75% of the time.

– Zacks

Another stat to keep bulls happy: When the S&P 500 is up more than 20% on the year heading into December (as is the case in 2021), December sees stronger-than-normal returns averaging 1.7 %. With this week’s gap to surprising distance from all-time highs, it certainly seems like history rhymes and we can end the year with a solid ending.

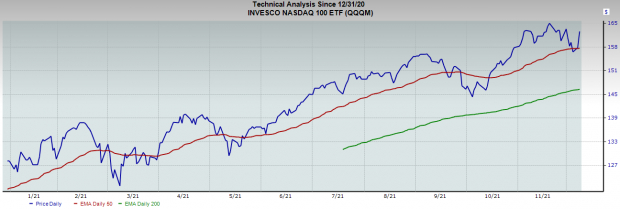

The Invesco Nasdaq 100 ETF QQQM has weathered recent volatility and is within 2% of its all-time highs. QQQM seeks to track the investment results of the Nasdaq 100 index and contains many of the world’s leading technology companies. The Invesco Nasdaq 100 ETF also has the three # 1 Zacks ranked strong buys that we will discuss today and is up about 27% on the year. As shown below, while many stocks tumbled in the previous weeks, QQQM appears to have found support amid its continued uptrend.

Image : Zacks Investment Research

Image : Zacks Investment Research

Let’s lift the curtain off three of QQQM’s holdings that have seen positive earnings estimate review activity in recent weeks, each of which earned our leading equity rankings.

Alphabet Inc. (GOOGL)

Alphabet is best known for its web-based search engine and provides advertisements, software applications, mobile operating systems, mapping technologies, and consumer content. Headquartered in Mountain View, CA, GOOGL also offers business solutions in addition to hardware and commercial products through its subsidiaries.

Between GOOGL’s strong cloud division, expanding data centers, and enhanced mobile search segment, Alphabet’s substantial revenue growth continues to impress investors. The company dominates the online search market with a 94% share. There’s also that video entertainment app … what’s it called again? Oh, it’s true. Youtube. Last year, YouTube alone generated $ 20 billion in ad revenue.

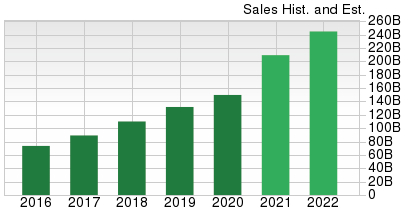

The Zacks Consensus Estimate for current-year revenue is $ 209.34 billion, a growth rate of 39.8% over 2020. This is an astonishing growth rate for a company of its size, and the sales trend appears to continue for GOOGL in 2022.

Image : Zacks Investment Research

Image : Zacks Investment Research

Alphabet has also made its way into other profitable markets such as autonomous driving and healthcare. Clearly, GOOGL is one of the most innovative companies in the world, and its stock has followed suit this year with a gain of more than 68% to date.

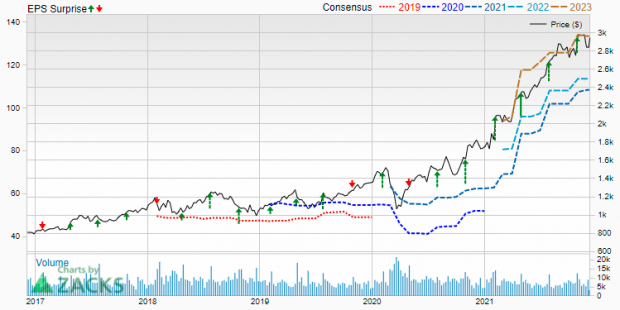

Alphabet Price (GOOGL), EPS Consensus and Surprise

Image : Zacks Investment Research

Image : Zacks Investment Research

GOOGL last reported EPS in October of $ 27.99, a positive 21% surprise over estimates. The company has produced an average earnings surprise of + 41.53% over the last four quarters. Analysts have increased their full-year earnings outlook by 6.31% to $ 108.29 over the past 60 days. If GOOGL simply meets this expectation, it would represent a roughly 85% increase in profits compared to 2020. Whether you’re a short-term trader or a long-term investor, having exposure to Alphabet is a good idea.

JD.com, Inc. (JD)

JD.com operates as a China-based online direct sales company. Through its website and mobile applications, JD offers a variety of products including mobile phones, computers, appliances, auto accessories, luxury goods, jewelry, and many more consumer goods.

Much has been said and written about China’s tech crackdown this year, and Chinese equities have responded negatively with many tech companies posting significant double-digit percentages on the year. The Chinese Internet ETF (KWEB) is down almost 44% this year. Despite the severe underperformance, JD has held up relatively well and is currently hitting a series of upper intermediate highs, looking to end the year on a high note.

Revenue is expected to grow nearly 36% this year compared to 2020. JD last reported November earnings of $ 0.49, a + 44.12% surprise over consensus. The company has posted a surprise average profit of 18.4% over the past four quarters.

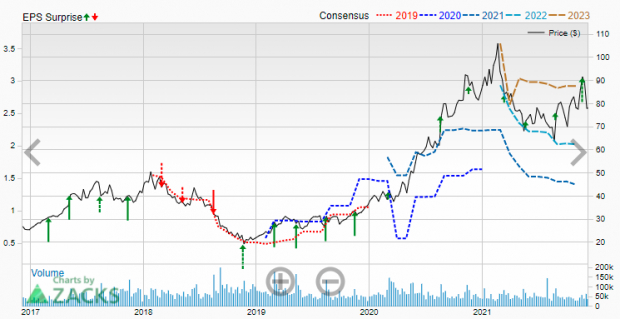

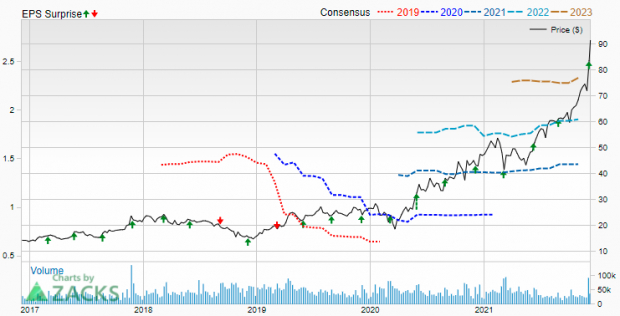

Price, consensus and EPS surprise from JD.com (JD)

Image : Zacks Investment Research

Image : Zacks Investment Research

In the past 30 days, analysts covering JD have increased their annual earnings estimates by 18.57% to $ 1.66. Looking ahead to next year, the Zacks Consensus Estimate for 2022 EPS stands at $ 2.18, which would translate into a growth rate of 31.63% this year. JD.com is scheduled to announce quarterly earnings on 10/3/22.

Marvell Technology, Inc. (MRVL)

Marvell Technology is a designer, developer, and marketer of analog, mixed, and digital signal processing ICs. MRVL is headquartered in Santa Clara, CA, and provides data infrastructure semiconductor solutions.

MRVL has benefited from strong demand for its network and storage chips from the 5G and data center end markets. The company last reported quarterly EPS of $ 0.43, a 13.16% surprise over consensus. MRVL has posted a surprise positive average earnings of 7.56% over the past four quarters, contributing to the stock’s 92% return this year.

Marvell Technology (MRVL) EPS Price, Consensus and Surprise

Image : Zacks Investment Research

Image : Zacks Investment Research

Revenues for the current year are estimated at $ 4.44 billion, which translates into a growth rate of almost 50% over last year. Analysts have raised their earnings estimates by 6.9% over the past week, and the Zacks Consensus Estimate for 2021 EPS is now $ 1.55. If MRVL can achieve this, the company’s profits will have increased by more than 68% compared to last year.

Looking at next year, analysts covering MRVL have recently revised EPS estimates to $ 2.21, a 15.7% increase from just seven days ago. Even with Marvell Technology’s stellar year, those estimates would represent a 42.62% increase in EPS.

Infrastructure Stock Boom Will Sweep America Down

A massive push to rebuild America’s dilapidated infrastructure will soon be underway. It is bipartisan, urgent and inevitable. Billions will be spent. Fortunes will be made.

The only question is “Will you take the right action soon when your growth potential is greatest?”

Zacks has published a Special Report to help you do just that, and it’s free today. Discover 7 specialty companies looking to get the most out of road, bridge and building construction and repair, plus freight transportation and energy transformation on an almost unimaginable scale.

Download for FREE: How to Profit from Billions in Infrastructure Spending >>

Want the latest recommendations from Zacks Investment Research? Today, you can download the 7 best stocks for the next 30 days. Click to get this free report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Invesco NASDAQ 100 ETF (QQQM): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research