Today’s precarious economic environment makes a strong argument for alternative retirement investments for the post-pandemic era. This, at least, is the prevailing sentiment among many investors and market-watchers who fear the effects of inflation, high borrowing costs, unstable foreign capital markets as exemplified by Evergrade, and a potential stock market pullback.

Due – Due

In fact, the year-over-year rise in the Consumer Price Index (CPI) for the 12-month period ending September 2021 was a staggering 5.4%. This jump exceeded expectations, and constitutes the biggest leap in the CPI since 2008, at the height of the global financial crisis.

Amid concerns of a highly inflationary economy and looming interest rate hikes, some investors are considering an alternative to their stock-heavy retirement investment portfolios to protect their wealth. Gold IRAs are their name, and they function identically to regular IRAs, except that they hold some percentage of their value in physical gold bullion.

As of last year, 10.8% of U.S. adults held gold as an investment. Today, this number is expected to be higher as the inflationary environment currently bodes well for hard assets. Naturally, this raises the question: Is a gold IRA a good investment in our past-pandemic economy?

What is a Gold IRA?

Before exploring the advantages and drawbacks associated with this retirement investment account, it’s important to first clarify a couple of things. First, what a gold IRA is and, second, what purpose it serves in an investor’s retirement portfolio.

A gold IRA is an individual retirement investment account in which some percentage of its allocation is in real gold. In order to classify as a gold IRA, these accounts cannot hold paper-based gold assets alone (i.e., mining stocks or ETFs)—rather, they must include physical bullion such as gold bars or sovereign-minted coins.

Even an IRA that allocates a mere 5% to gold bullion and the remaining 95% to stocks and bonds meets the criteria of a gold IRA. Simply put, any IRA is a gold IRA as long as some share of its value consists of physical gold assets.

The Purpose of a Gold IRA

Like all IRAs, gold IRAs provide special tax benefits for their owners. Traditional gold IRAs consist of pre-tax assets for which taxation is deferred until withdrawal, whereas Roth IRAs are made up of after-tax assets which grow tax-free.

Assets held within a Roth IRA are free from long-term capital gains taxes, whereas traditional IRAs are deducted upon deposit but taxed at withdrawal.

These tax benefits especially tempt precious metals investors. This is because investors typically hold gold and silver assets long-term, and can accrue a large tax liability at the time of sale. Thus, gold IRAs allow investors to contribute to their retirement nest egg on a tax-free basis while diversifying with alternative assets that can help manage risk.

Why Gold?

Gold has a long history as an investment and, more than that, as a reliable store of value. Dating back to 550 BC during the reign of King Croesus in modern-day Turkey, gold has been used to mint official coins and serve as a medium of exchange.

Given gold’s unique properties as a scarce, ductile, reflective, brilliant, and malleable metal, it has long been considered a prized commodity throughout the world. On top of that, its thermal and electric conductivity make it highly coveted as a modern industrial asset.

For retail investors, gold has come to be regarded as a disaster hedge. When the U.S. stock market experiences sustained downturns, the spot price of gold tends to perform positively. Consider the performance of gold during the following bear markets relative to the S&P 500:

- Black Monday 1987: -22.6% (S&P), +4.2% (Gold)

- Aug. 1 to 14, 1990: -21% (S&P), +11.1% (Gold)

- Oct. 2, 2000 to Oct. 2, 2002: -38.5% (S&P), +18% (Gold)

- Oct. 9, 20087 to Oct. 1, 2010: -20.1% (S&P), +78.9% (Gold)

- Dec. 1, 2019 to March 1, 2020: -19.8% (S&P), +7.6% (Gold)

It should go without saying that there are, and always will be, exceptions to this trend. However, the fact remains that gold has a tendency to outperform the equities market during times of systemic instability, uncertainty, and even outright recessions.

Diversification Benefits of a Gold IRA

Perhaps the main advantage of a gold IRA is that it provides unique risk management capabilities for retirement investors. As we near our target retirement date, it’s crucial that we manage risk accordingly. In particular, it’s important to reduce the chances of losing our financial res when we need them the most—during retirement.

A simple stock market downturn or overnight sell-off could delay your retirement by years if you’re overexposed to stock market volatility. Knowing this, many investors nearing retirement choose to diversify their holdings to minimize their exposure to stock market risk.

The underlying premise is that gold has a low correlation (about ~0.25) to the stock market. Therefore, it functions as an extremely useful hedge against stock market volatility. Statistically, gold bullion markets stand strong when the stock market rises or falls in value, thereby fortifying an investor’s portfolio from erratic swings.

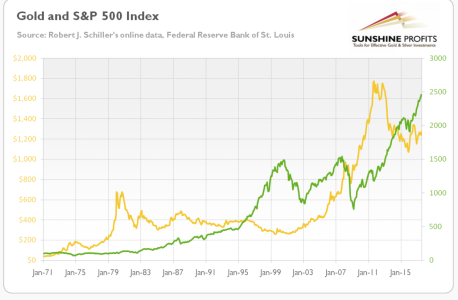

Figure 1. : Sunshine Profits

The chart above (Fig. 1) demonstrates that, although gold (yellow line, left axis) sometimes experiences sustained co-movement with the S&P 500 index (green line, right axis), there are nevertheless many instances of an inverse relationship. This is particularly evident in 1980, from 1997 to 1999, in 2008, 2012, and 2016—in each case, the price of gold moved opposite to the price of the S&P 500.

Alternative assets such as gold bullion are marked by much lower liquidity than stocks. Therefore, they cannot be bought and sold as quickly. The result is that fewer rash, knee-jerk reactions are made by gold investors, and market sentiment has more time to cool off and stabilize before investor behavior can aggravate the problem.

Risk Differentiation

In order to truly diversify your portfolio, you need to diversify not only the types of assets in which you invest, but also the types of risks you’re exposed to. There are five predominant forms of risk that investors must be aware of:

- Equity Risk (Equity Beta): A stock’s volatility relative to the market.

- Interest Rate Risk (Duration): The risk of a change in the federal funds rate changing the value of a bond or variable-rate instrument, such as an annuity.

- Credit Risk